Search

People also search for:

our services:

quick contact:

Understanding the Med Spa Revenue Cycle

Understanding the Med Spa Revenue Cycle: Why Most Owners Get It Wrong—And How to Fix It

In the med spa industry, most owners are hyper-focused on top-line revenue. They think, If I just make more money, all the problems will go away. But here’s the truth: it’s not about how much money your med spa brings in—it’s about how that money flows through your business.

Understanding the med spa revenue cycle is one of the most overlooked yet critical factors for achieving long-term profitability and scalability. In this blog post, we’ll break down what the revenue cycle really is, where most owners go wrong, and how to create a system that supports strong cash flow, clean data, and predictable growth.

What Is the Revenue Cycle—And Why Is It Often Misunderstood?

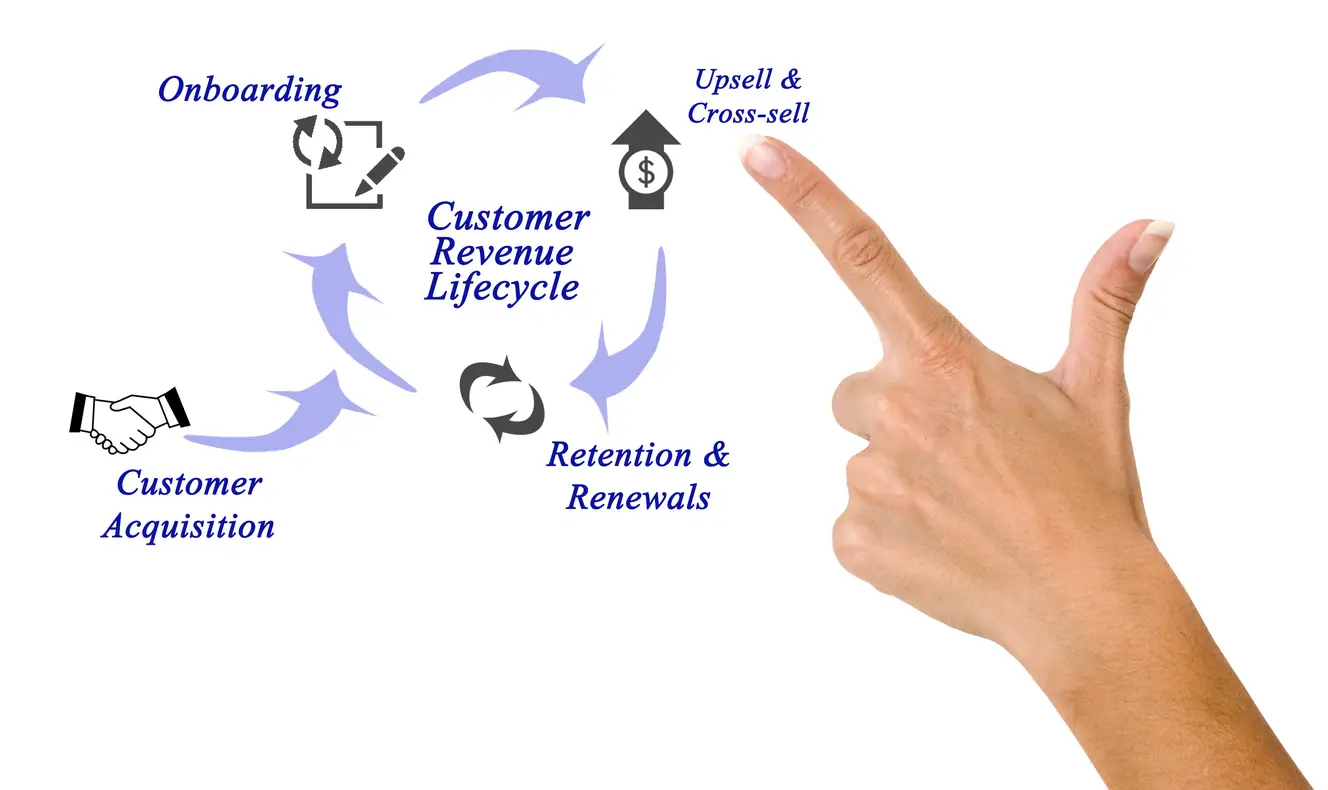

The revenue cycle refers to the entire process that begins when a client engages with your med spa and ends when the payment is fully collected and recorded. It includes marketing, lead conversion, scheduling, service delivery, billing, collections, reconciliation, and reporting.

Think of it like plumbing: it’s not just about how much water comes in. If there are leaks, clogs, or inefficiencies, the flow breaks down—and your profits get drained.

Most med spa owners don’t manage their revenue cycle consciously. They run their business reactively—focusing on “getting people in the door” without building the infrastructure needed to sustain and scale operations.

Where Most Med Spas Go Wrong

1. No Control Over Front-End Lead Conversion

Your revenue cycle starts before the patient even walks in the door. If your front desk isn’t trained to answer the phone, follow up on leads, or handle objections, your marketing spend is wasted.

Common symptoms:

- High ad spend, low ROI

- Low consultation show rates

- Long response times to inquiries

Fix it: Implement phone and script training, lead tracking systems, and clear follow-up protocols for all inquiries.

2. Poor Scheduling and Capacity Management

Your schedule is your revenue engine. If it’s not optimized, you’re leaking income.

Common issues:

- Double-booking or large gaps in schedules

- Not prioritizing high-revenue services

- Low provider utilization

Fix it: Use scheduling software that tracks provider availability, service durations, and real-time productivity. Schedule revenue-generating services in peak hours and delegate admin work outside of those windows.

3. Untrained Providers on Upselling and Rebooking

Most providers are clinically trained, not business-trained. If your team isn’t recommending complementary treatments or rebooking patients, you’re missing revenue opportunities.

Common issues:

- Low average revenue per appointment

- High patient churn

- One-and-done visits

Fix it: Train providers to offer treatment plans, track rebooking percentages, and use KPIs like revenue per provider.

4. Broken Point-of-Sale (POS) and Billing Practices

You’d be shocked how many med spas don’t reconcile transactions daily. Incomplete or misclassified payments lead to revenue leakage, inaccurate books, and tax headaches.

Common issues:

- Incorrect sales attribution (wrong provider)

- Missing product/service codes

- Inaccurate reporting for commission and bonuses

Fix it: Use integrated EMR and POS systems. Audit daily sales, reconcile payments, and tag every transaction to a provider and service.

5. No Visibility Into Financial KPIs

If you don’t know your average revenue per hour, utilization rate, or cost per lead—how can you scale?

Common symptoms:

- Unprofitable services being promoted

- Hiring decisions based on “being busy,” not being productive

- Bonus structures not tied to performance

Fix it: Build a monthly dashboard with core KPIs: Revenue per provider, no-show rate, average ticket, membership retention, gross margin, etc.

How to Diagnose and Fix Net Margin Leak — Step by Step

Here’s a practical roadmap to diagnose where your net profit margin is leaking and how to fix it.

Step 1: Build a Clean Cost Spreadsheet

- List all fixed costs: rent, utilities, insurance, software, leases, salaries, overhead, marketing, maintenance.

- List all variable costs: consumables, injectables, supplies, credit‑card fees, product costs, taxes, packaging, etc.

- Track employee hours and associate revenue by provider.

- Include debt service and loan or equipment payments.

This gives you a clear baseline.

Step 2: Calculate Gross Profit Margin and Net Profit Margin

- Gross Margin = (Total Revenue – Variable Costs) / Total Revenue

- Net Margin = (Total Revenue – Total Costs [fixed + variable + debt]) / Total Revenue

Compare with industry benchmarks — if your gross margin looks healthy but net margin is weak, fixed costs or inefficiencies are the issue.

Step 3: Audit Utilization and Efficiency

- Review provider schedules: are there gaps? Overlaps? Downtime?

- Check room utilization rates: are rooms or machines idle?

- Examine productivity per provider: hours worked vs revenue generated

If utilization is low, restructure scheduling, discounts, or service mix.

Step 4: Review Pricing, Service Mix, and Upsell Strategy

- Are services priced too low given costs?

- Do you have a balanced mix of high-margin and high-volume services?

- Are rebooking and retail sales systematically offered?

- Are staff incentivized to upsell or rebook?

Adjust pricing, increase high-margin services, and implement upsell protocols.

Step 5: Cut Redundant or Wasteful Expenses

- Evaluate fixed costs monthly. Cancel or renegotiate unnecessary subscriptions, marketing, vendor contracts.

- Monitor consumable usage strictly — reduce waste, limit comps, control samples.

- Reassess financing: avoid high-interest or balloon loans unless ROI is clearly forecasted.

Step 6: Build a Cash Flow and Reserve Strategy

- Keep 2–3 months of operating expenses in reserve to hedge against seasonal swings or emergencies.

- Forecast cash flow monthly and quarterly with best-case / worst-case scenarios.

- Avoid overcommitting to expansion until profit margins are strong and sustainable.

The Correct Revenue Cycle: Step-by-Step Breakdown

Here’s what a healthy med spa revenue cycle looks like:

1. Marketing → Lead Generation

Track:

- Cost per lead

- Lead source attribution

- Conversion rates to consultation

Use:

- CRM integrations (e.g., Hubspot, PatientNow, Boulevard)

- Response time tracking

- Automations for email/text follow-ups

2. Lead Management → Booking

Track:

- Consult scheduled rate

- Call-to-book ratio

- Consult show-up rate

Ensure:

- Phone scripts are used

- Staff is trained to handle price objections

- Automated reminders are sent

3. Consult → Conversion

Track:

- Consult-to-treatment conversion rate

- Average revenue per new client

Tools:

- Standardized consultation templates

- Financing options presented

- Bundles or membership options explained

4. Service Delivery → Upsell + Rebooking

Track:

- Rebooking rate

- Retail sales per visit

- Add-on service percentage

Ensure:

- Treatment plans are offered

- Product recommendations are made

- Next appointments are booked before patients leave

5. Point-of-Sale + Payment Collection

Track:

- Revenue per provider

- Average ticket size

- Provider sales mix

Ensure:

- Accurate provider and service attribution

- Commission rules are applied

- Payments are reconciled daily

6. Financial Reporting + KPI Review

Track:

- Daily, weekly, monthly dashboards

- Provider productivity benchmarks

- Expense-to-revenue ratio

Tools:

- QuickBooks, Gusto, Boulevard reports, or a CFO dashboard

- Color-coded team KPIs shared weekly

Fixing Your Revenue Cycle: How to Start

You don’t have to overhaul everything overnight. Start by asking:

Do I have a full map of my revenue cycle—from marketing to deposit in the bank?

If not:

- Pick one leak to fix. Maybe it’s poor rebooking, low consult conversions, or inaccurate POS data.

- Set a measurable KPI goal. Example: Improve consult-to-treatment conversion from 60% → 75%.

- Train, track, and incentivize. Align staff bonuses to the part of the cycle they influence.

- Build weekly dashboards. Review trends before they become problems.

Benefits of a Strong Revenue Cycle

When your revenue cycle is optimized, you get:

More predictable revenue

Higher profit margins

Better staff accountability

Stronger cash flow

Smoother expansion readiness

You’re no longer guessing—you’re running a business that scales with intention.

Final Takeaways

Most med spa owners are laser-focused on top-line revenue, but forget the systems that make revenue stick. If you don’t know your numbers—or if you’ve been treating symptoms like poor sales or cash flow issues—it’s time to zoom out and look at your entire revenue cycle.

Control the cycle. Control the outcome.

By tracking, optimizing, and aligning your team around each stage of the revenue cycle, you turn chaos into clarity—and revenue into real profit.

Refer our other article to learn about many med spa owners fall into financing mistakes, as explained in The Debt Trap in Med Spas.